MBA in International Finance (integrated with ACCA, UK)

In association with

Exemptions for ACCA

9 PapersRecommended 12 hrs/week

12 MonthsBatch Start, Limited Seats Available

Coming SoonBlended Learning

Recorded & Live SessionsAccreditation

Accredited by ACCA, UKEligibility Criteria

Bachelor’s DegreeAbout the Program

This MBA in International Finance program is integrated with the prestigious ACCA (Association of Chartered Certified Accountants) qualification, providing the highest number of exemptions (a total of 9) in the Knowledge & Skill Modules. By completing just four ACCA external examinations, students can qualify for this accredited program. Fast-track your path to a rewarding senior management role with a solid grasp of finance through this unique MBA experience.

MBA in International Finance

An MBA in international finance equips graduates with a skill set in global financial management, risk assessment, and strategic decision-making. It opens doors to rewarding careers in multinational corporations, investment banks, consulting firms, and financial institutions around the globe.

Prepare for ACCA

Our ACCA preparation program offers comprehensive training to excel in the ACCA exams. With exemptions granted for 9 out of the 13 ACCA exams, it fast-tracks your path to certification, enabling you to gain a globally recognized qualification and enhance your career prospects in accounting and finance.

Career Opportunities

Prepare yourself for the highly-competitive job market through an access to upGrad's Career Portal, along with professional resume and cover letter writing tools. The additional content on soft skills, interview techniques, and problem-solving not only refines your personal brand but also equips you with the essential skills needed to navigate the complex challenges of the finance industry.

Program Overview

Key Highlights

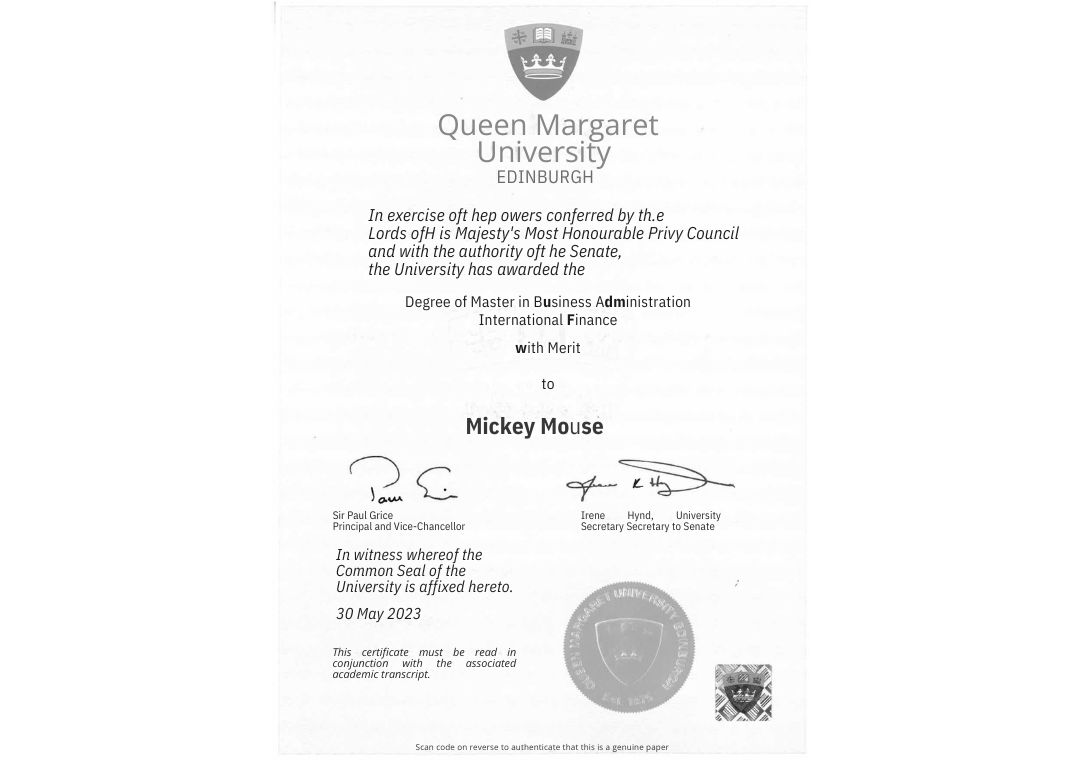

Founded in the year 1875, Queen Margaret University has been driven by the aim to impart quality education to its students. Initially, it was established as the Edinburgh School of Cookery by its founders Christian Guthrie Wright and Louisa Stevenson. Over the years it has grown and expanded to encompass a broad range of subject areas in which it is widely recognised for its expertise. In the year 2007, it adopted the title Queen Margaret University, Edinburgh (QMU). QMU aims to facilitate an experience of learning that enables students to achieve their individual goals, make a positive contribute to society and help create a better world. By providing an optimal balance of practical and theoretical education, it prepares students for successful careers.

Syllabus

Best-in-class curated curriculum designed and taught by industry leaders.

Top Skills You Will Learn

Job Opportunities

Who Is This Program For?

Minimum Eligibility

- Master the foundations of business and specialise in international finance & accounting

- Gain practical and relevant industry knowledge taught by business leaders

Get 2 industry-relevant micro-certifications in the below cutting-edge disciplines, setting you apart in the competitive finance industry.

Product Management

Financial Risk Management

New-Age Leadership

Entrepreneurship

Explore our Learning Platform

Syllabus

Best-in-class content curated and taught by industry leaders in the form of videos, cases and projects, assignments and live sessions

Leadership and change management

Crisis Management

Research Methodologies and objectives

Business performance management

International financial reporting

International financial management

Audit and taxation for business

Dissertation (focused on international finance)

Instructors

ACA Deepak Agarwal

Madesh Kuppuswamy

Shiroshan Thiyagaraja

Jyothika Ramadas

Laxmi Swetha Boddapati

Starting at Rs. 6,808/ month. No cost EMI options available

₹ NaN (Inclusive of taxes)

Admission Process

Step 1

Complete Application

Fill out the MBA application form

Step 2

Give the Entrance Test

Give the test if applicable. Go through the eligibility criteria to check for exemption.

Step 3

Receive the Offer Letter

Candidates are shortlisted basis their academics and work-ex, and sent the offer letter

Step 4

Complete the Payment

Block your seat by paying the caution amount. Pay the remaining fee within the given time

Empowering learners of tomorrow

upGrad MBA Learners Work At

Refer someone and Earn upto INR 80,000 Cashback/Vouchers, on every successful enrollment

Your friend also gets an instant scholarship!

Disclaimer

Frequently Asked Questions

Program Details

Is there an eligibility criteria for this program?

This MBA program is open for learners who fulfill the below criteria:

- Any Bachelor’s Degree and proficiency in English

What is the admission process?

The admissions process is completely online. The following are the key steps in the application process:

Step 1 - Fill out the MBA application form

Step 2 - Give entrance test if applicable as per the eligibility criteria”

Step 3 - Get shortlisted and receive the offer letter

Step 4 - Block your seat and Complete the Payment

What kind of certification will I get after completion of this course?

Post successful completion of this program, you will get an MBA from Queen Margaret University.

Can I do the MBA Program from my city?

You can learn this program from any city provided you are attending the classes scheduled.

Program Learning Experience

Will I be able to complete this program being a busy working professional?

The program is specially designed for working professionals to enable effective learning while they continue their jobs/existing pre-dispositions. Apart from the face to face taught classes, the recorded content can be consumed on the website or mobile application on the go.

How would these real-industry projects help me?

Our programs have a strong experiential component that will prepare you to apply your learning on the job. Learn - Experience - Apply. Case Studies and industry projects will help you to experience real-life challenges in Management. These will enable you to step into the shoes of leading managers at companies and put to use the theoretical learning in an experiential manner. Post this programme, these will serve as a portfolio of projects you can illustrate to advance your career.

Payment

How much do I pay to block my seat?

You need to pay ₹ 15,000 to block your seat.

Is there any deferral or refund policy for this Program?

Refund Policy:

- Student must pay applicable caution money for the enrollment of the course. This will be adjustable against the total course fee payable by the student.

- There shall be no refund applicable once the program has started. This is applicable even for those students who could not complete their payment, and could not be enrolled in the batch opted for. However, the student can avail pre-deferral as per the policy defined below for the same.

- Once the student pays block amount, ""any"" refund shall be subject to deduction of ₹10,000 processing charges.

- Student has to pay the full fee within 7 days of payment of caution money or cohort start date, whichever is earlier, otherwise, the admission letter will be rescinded and processing fee of ₹10,000 will be levied.

- Refund shall be processed to an eligible student within 30 working days from the date of receipt of written application from him/her in this regard. - For detailed refund policy, speak to an upGrad Admission Counselor.

Deferral Policy:

- For learners who sign up for the program but want to postpone their start date or want to take a break during the program, there is a deferral provision available.

- For detailed deferral policy, speak to an upGrad Admission Counselor.

No Cost Credit Card EMI FAQ's

0% EMI with Finance partners /Credit card option availability will vary program wise.

1. Which banks allow using 0% Credit card EMI or Credit card EMI?

No cost EMI is available on credit cards from all major banks (American Express, Bank of Baroda, HDFC Bank, ICICI Bank, IndusInd Bank, Kotak Mahindra Bank, RBL Bank, Standard Chartered, Axis Bank, Yes Bank, State Bank of India, CITIBANK and HSBC).

2. Is there any minimum transaction limit ?

Yes. 50000 is the minimum.

3. Standard Chartered Bank offers 18 or 24 months No Cost EMI ?

No. ONLY 12 months is available irrespective of the Program enrolled.

4. Will I have to pay any extra amount for EMI transaction?

If you are availing 0% credit card EMI, upGrad will not charge any processing fees or down payment for these transactions. Your bank may levy GST or other taxes on the interest component of the EMI.

5. Are there any fees or down payment?

Certain banks charge nominal processing fees between INR 99 - 500 on 0% Credit Card EMI transaction. If charged, will be billed in the first repayment installment.

6. Can I use my International credit card for 0% credit EMI or Credit Card EMI?

Only the Indian bank credit cards can be used. But you can pay the amount using the Credit card option in one shot / part payments, and later you can convert into EMI from your respective bank. The tenures and interest charged will depend on your bank. upGrad will not charge any processing fees or down payment for these transactions, this will be purely between you and your bank.

7. Are there any charges in case I opt for cancellation/refund from the course after paying balance with no cost EMI ?

Yes, there will be additional charges to the extent of interest paid by the upGrad to the bank, you will be refunded only Principal amount, i.e. the amount actually deducted/blocked from your card. This deduction will be in addition to the amount mentioned in the refund policy shared with your offer letter.

8. Can I Pay Using Multiple Credit Cards ?

Multiple cards can be used to complete the payments using Part payment option make sure to inform the learner, minimum transaction is INR 50000 to opt for 0% CC EMI E.g. Amount to be paid: 150000. I can pay using 2 Credit cards. Yes, Example :

HDFC Card – Part payment – INR 100000

ICICI Card – Part payment – INR 50000

9. How can I opt for Credit card EMI if my bank is not listed in the 0% Credit card EMI or Credit card EMI?

You can pay the amount using the Credit card option in one shot / part payments, and later you can convert into EMI from your respective bank. The tenures and interest charged will depend on your bank. upGrad will not charge any processing fees or down payment for these transactions.

10. Why is the entire amount blocked on my credit card?

Initially your bank will block the entire amount from your available purchase limit and from your next billing cycle, you will be charged the EMI amount. As you start paying your EMI, your credit limit will be released accordingly. For example, if you have made a payment of ₹100000 on 6-months EMI and your credit limit is ₹200,000 then initially your bank will block your credit limit by ₹100000. After payment of your first month EMI of Rs.15000, the blocked amount will come down to ₹85000.

11. Why is interest getting charged on No Cost EMI?

Your bank will charge you interest. However, this interest charge has been provided to you as an upfront discount at the time of your payment, effectively giving you the benefit of a No cost EMI. The total amount paid during the entire EMI tenure to the bank will be equal to the amount to be paid to upGrad.

Eg. Amount payable to upGrad: INR 405000

Let's say Amount deducted at the time of transaction: INR 379850 (Principal amount) Bank charges interest of 12-15% per annum on INR 379850

[Note: Interest factor is reducing rate and not Flat rate]

EMI AMOUNT = INR 33750 x 12 = INR 405000

Effectively, you have taken loan on 379,850 instead of 405,000